Navigating the Venture Capital Secondary Market

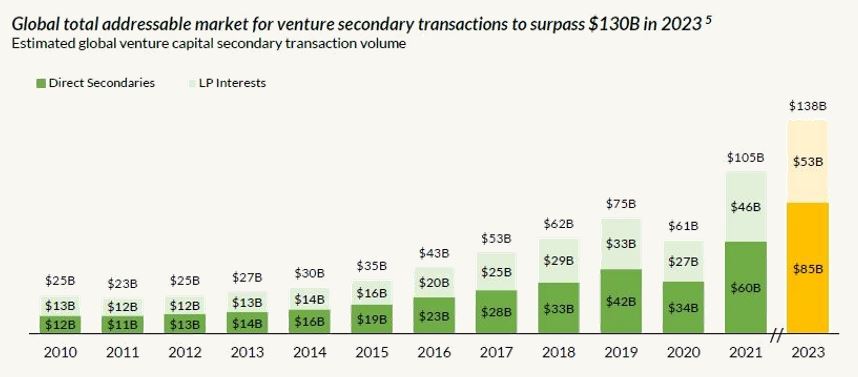

In the ever-evolving landscape of venture capital, the venture capital secondary market has gained continued prominence over the past 12 months amid a drought of exits for investors leading to secondaries transactions becoming increasingly popular as a solution for LP liquidity. With estimates putting the venture capital secondary market, at a value exceeding $100 billion, combined with favourable market conditions including lower competition, the availability of large discounts and the potential for higher returns. Significant opportunities will be presented to investors who strike whilst the iron is hot.

We will delve into some of the key transformative impact secondaries are having on the start-up ecosystem whilst looking at the challenges and risks that come with investing in secondary markets.

Impact on the Start-up Ecosystem

Valuation Dynamics: The secondary market doesn't just offer liquidity; it actively influences the valuations of start-ups. The perceived value of a company in the secondary market can set the tone for subsequent funding rounds. Furthermore, it could alter the landscape during subsequent funding rounds with investors armed with secondary market insights, having the ability to recalibrate their strategies.

Early investors’ Advantage: The secondary market provides early investors with the ability to cash out before an IPO or exit event, transforming traditionally illiquid assets into tangible gains and providing much needed liquidity.

Employee Empowerment: With the ability to cash in on their equity pre-IPO newfound financial flexibility could influence employees career decisions and company loyalty. Additionally, with employees able to participate in the financial success of the start-ups they work for, it has the ability to alter the dynamics of employee incentives schemes moving forward.

Challenges and Risks

Regulatory Complexities: The secondary market faces regulatory hurdles. Navigating these complexities is crucial for its continued growth and stability, whilst being essential to maintain market integrity and protect investors.

Information Asymmetry: Access to comprehensive information about private companies in the secondary market can be limited. Investors may face challenges in conducting thorough due diligence, relying on fragmented data to make investment decisions.

Mutual Profitability: Both sellers and buyers need to make money for the venture secondary market to thrive.

In conclusion, despite the challenges and risks associated with the secondary market, the venture capital secondary market will quickly became a standard tool in the VC ecosystem due to the incredible opportunities they present for investors who are under ever increasing pressure to provide returns to investors.

Written by Aaron Gutteridge, Investment Associate at Angels Den, Europe and UK’s largest angel-led finance platform helping early stage companies and SMEs get easy access to growth capital.