Technology is revolutionising almost every aspect of day-to-day lives and business operations. Whether we are referring to accounting or pizza delivery, AI and RPA have streamlined so many processes that jobs as we currently know them will become redundant. Change is inevitable in every sector.

The financial services market has always been one of the most profitable ones, but it has been rather reluctant to innovation in the past century. Once automation started to benefit so many cross-sector businesses, financial services providers realised the real impact of modern technology on their industry. Being already profitable, automation and other related processes led to a new revolution in this sector.

In the UK, the FinTech market is one of the best places for investment and innovation. In 2018, 10% of the total equity investment made in this country was in this sector’s startups. The effect of this trend is that 5 out of the 14 unicorn startups in this country are FinTech ones.

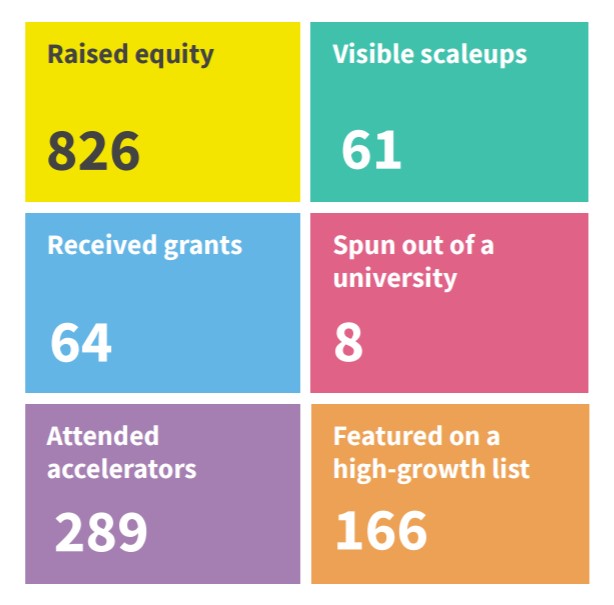

Source: Beauhurst.com

Funding in this industry has been growing continuously for the past 8 years in the UK. In 2011, only 48 companies have raised £121 million. In 2018, 433 startups raised £1.85 billion and 2019 is expected to be an even better year, as almost a billion pounds were raised in the first quarter.

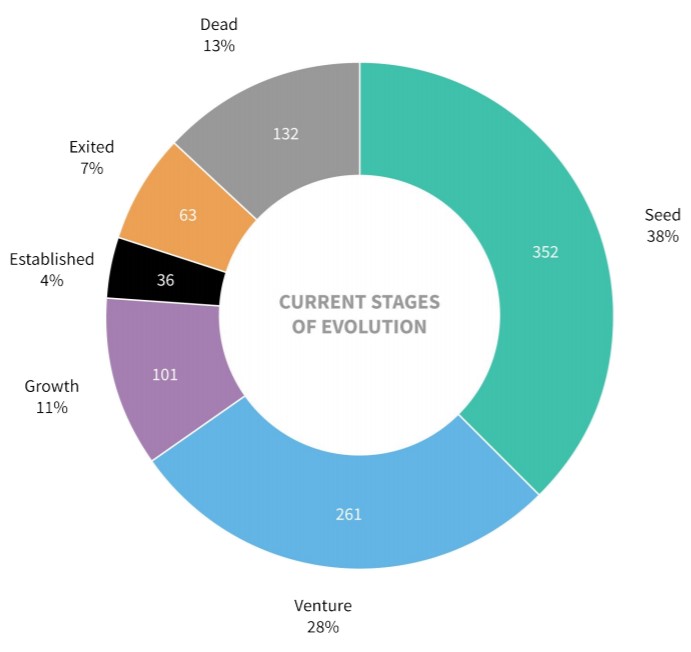

Investors are interested in FinTech and they have good reasons, such as profitability and continuity. Because of the capital put at their disposal, startups are able to market their solutions easily and attract all kinds of customers. As the whole goal of this industry is to streamline and provide new services that traditional banks and financial institutions are unable to, a perfect combination between customer satisfaction and profitability is reached. These statements are backed by statistics, as from 935 FinTech startups that have ever existed in the UK, 63 have exited through an IPO or acquisition and 750 are still in business today.

Source: Beauhurst.com

At Angels Den Funding, one of our forefront priorities is to constantly deliver innovative investment opportunities that are in-line with the current trends. After going through a rigorous selection process, many FinTech startups were featured on our platform and successfully raised funding. Some of the most notable companies from this sector that have raised funding with us are Coriolis Technologies and Baanx.

Although these two closed their funding rounds with us earlier this year, we continue to feature similar startups every month. Check them out using the button below: